Turn complex data into clear, actionable insights

Agentic AI autonomously streamlines operations, ensures compliance, and personalizes financial services.

Finance Operations at a Glance

AI solutions help financial institutions move from reactive to proactive, data-driven decisions, optimizing performance and mitigating risk.

10-25%

10-25%

10-25%

10-25%

5-15%

5-15%

10-25%

10-25%

Transforming Finance with Intelligence

Risk Management

Agents analyze risk, detect fraud, and predict volatility for smarter decisions.

Operational Efficiency

Agents automate transactions, compliance, and reporting, cutting manual effort.

Regulatory Compliance

AI tools monitor regulations and ensure compliance, reducing risks and penalties.

Customer Experiences

Analyze customer data to deliver personalized financial products and services.

Unlock Operational Excellence with AI

By automating complex processes, analyzing vast datasets in real time, and enabling smarter decision-making, the organization achieved substantial cost savings, improved efficiency, and faster response times setting a new benchmark for innovation and performance in the financial sector.

Request a Demo

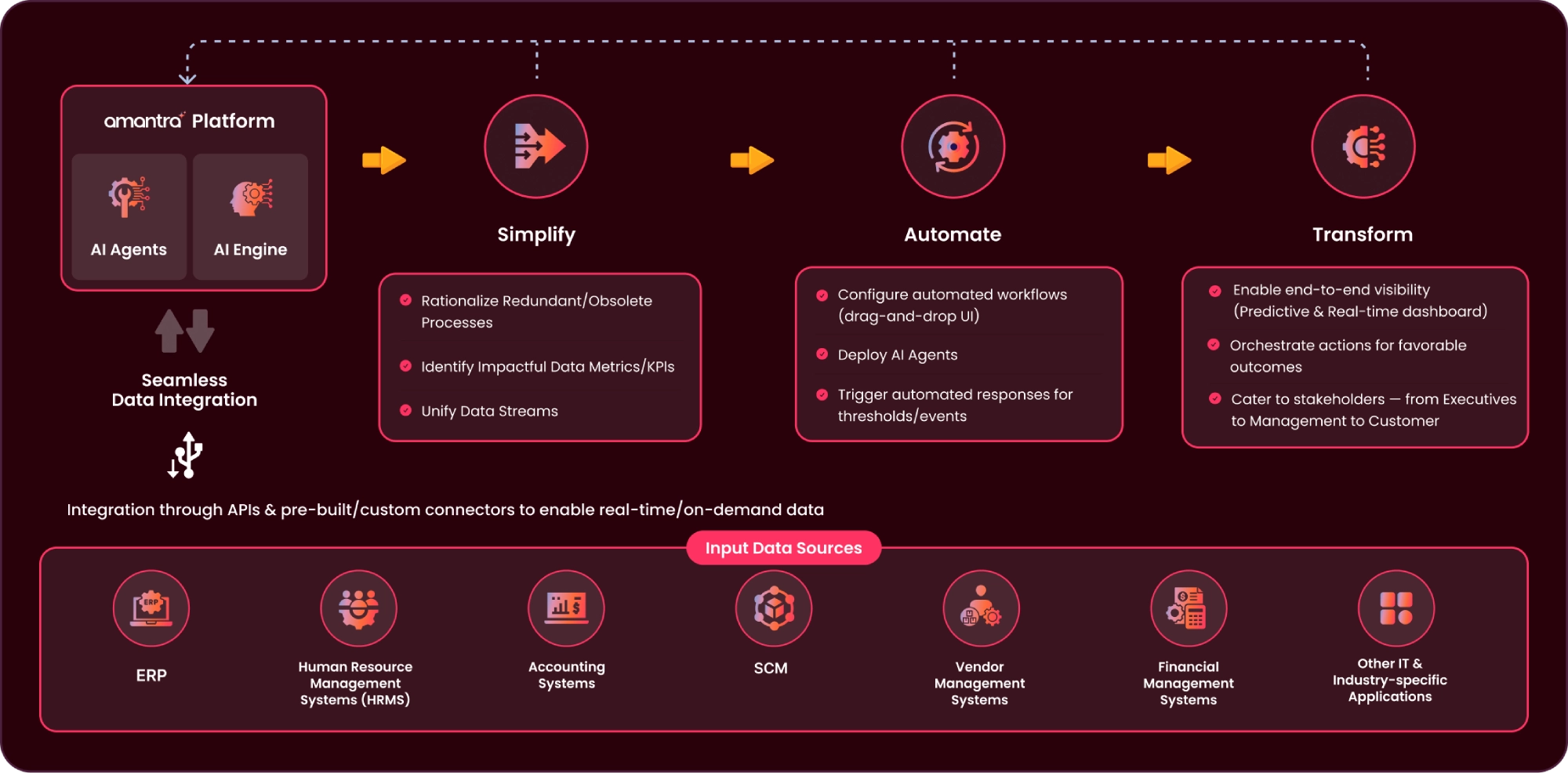

Solution Approach

Featured AI Use Cases for Finance

Fraud Prevention

Analyze transaction patterns in real time to detect anomalies and block fraudulent activities instantly.

Credit Assessment

Evaluate diverse data sources to measure creditworthiness and predict risk with greater accuracy.

Algorithmic Trading

Analyze market movements continuously to execute trades at the best possible moments for maximum returns.

Customer Assistance

Handle inquiries instantly through intelligent chatbots, improving response time and customer satisfaction.

Regulatory Automation

Generate and validate compliance reports automatically, ensuring accuracy and timely submissions.

Risk Monitoring

Track market and portfolio risks dynamically, enabling proactive decision-making and greater financial stability.

Why Choose Amantra for Finance?

From seamless integration to real-time analytics, Amantra’s AI-driven automation solutions are designed to address the unique challenges of the finance industry. Optimize your financial operations, scale effortlessly to handle growing data volumes, and strengthen compliance and risk management capabilities.

Contact Us today to learn how we can help transform your operations.

Request a Demo