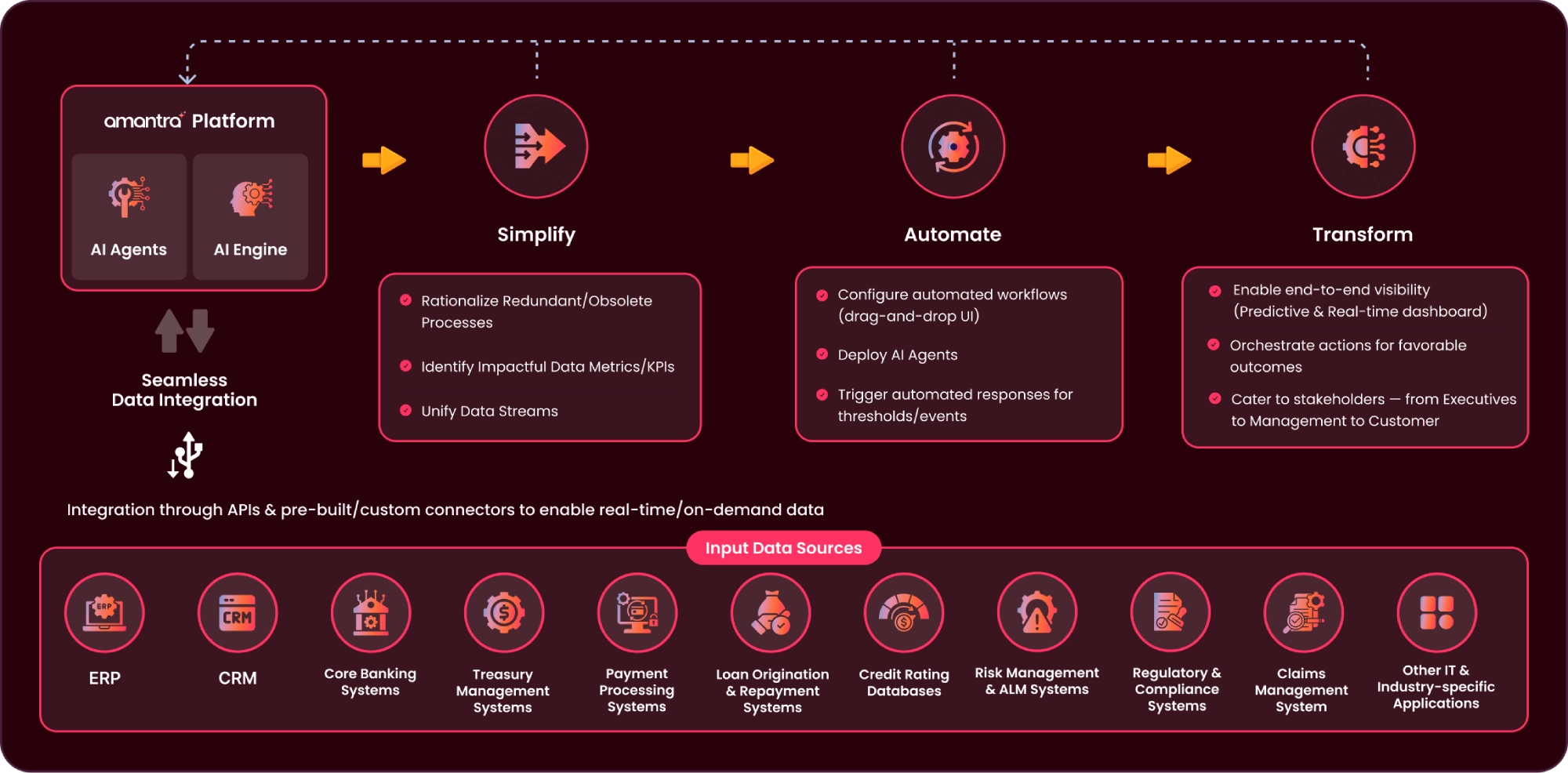

Beyond transactions. Seamless smarter finance.

Harness Amantra AI to streamline operations, ensure compliance, and personalize financial services.

Banking, Finance & Insurance Data at a Glance

Drive efficiency and trust with Amantra AI’s real-time analytics for fraud, credit, and customer personalization

10-20%

10-20%

10-40%

10-40%

20-40%

20-40%

10-25%

10-25%

Agentic Financial Intelligence

Risk Management

AI agents continuously analyze transactions, detect anomalies, and prevent fraud in real-time.

Decision Intelligence

Transform raw financial data into actionable insights, enabling faster and more accurate decisions.

Automated Processes

Streamline reconciliations, reporting, and claims handling with minimal human intervention.

Predictive Analytics

Anticipate market trends, optimize cash flow, proactively manage credit risk, and uncover hidden opportunities in real time.

AI-Driven Fraud Detection in Banking

A leading bank implemented Amantra’s AI solutions to monitor transactions in real-time, identifying and preventing fraudulent activities. This proactive approach led to a significant reduction in fraud-related losses and enhanced customer trust.

Case study

Solution Approach

Featured AI Use Cases for BFSI

Fraud Prevention

Detect unusual patterns and anomalies in real time to prevent fraudulent activities and protect assets.

Credit Assessment

Analyze alternative data sources to evaluate creditworthiness, enabling smarter and more inclusive lending decisions.

Claims Automation

Automate the evaluation and settlement of insurance claims, reducing processing time and improving accuracy.

Compliance Monitoring

Continuously track regulatory requirements and flag potential risks, keeping operations fully compliant.

Service Automation

Handle routine customer inquiries through virtual assistants, freeing human agents for complex problem-solving.

Risk Analytics

Analyze transactional and behavioral data to identify emerging risks, empowering proactive decision-making.

Why Choose Amantra for BFSI?

From seamless integration to real-time analytics, Amantra’s AI-driven automation solutions are designed to address the unique challenges of the banking, finance, and insurance industries. Streamline your operations, scale effortlessly to meet growing business needs, and enhance customer experiences through personalized services.

Contact Us today to learn how we can help transform your operations.

Request a Demo